Newsroom

ICBC posts net loss of $860 million for first nine months of fiscal year

February 07, 2019

ICBC has posted a net loss of $860 million for the first nine months of its current fiscal year (April 1 to December 31, 2018) as the pressures caused by the rising cost of claims – particularly litigated injury claims – continues to escalate.

ICBC's net claims incurred for the first nine months of its fiscal year are close to $5 billion, an increase of approximately $600 million over the same period last year, and ICBC is now projecting a year-end net loss of $1.18 billion.

Major reforms are coming to auto insurance in B.C. on April 1 – primarily a limit on pain and suffering payouts for minor injury claims which, along with a new dispute resolution process, are projected to help save approximately $1 billion per year while also allowing for substantially increased care for anyone who is injured in a crash.

ICBC is committed to continuing to work alongside government to help alleviate the rapid growth in claims costs which are putting increasing pressure on the auto insurance rates British Columbians pay.

ICBC's ongoing financial net losses continue to be driven by increased claims settlement costs which are much higher than anticipated, and aggressive pressure from plaintiff counsel which is leading to higher settlement demands and slower claims closure rates. There has also been an increase in the number of large loss claims which run into hundreds of thousands of dollars each, in particular, large loss injury claims from prior years continue to grow in cost.

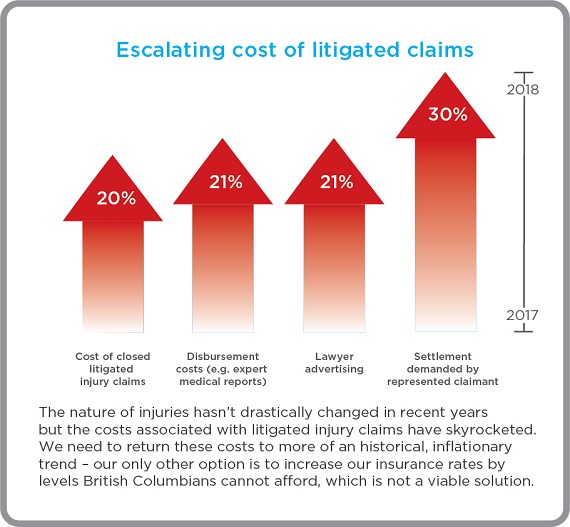

The rising cost of litigated injury claims is the single biggest pressure currently being put on ICBC and the insurance rates British Columbians are paying. The average cost of closed litigated injury claims has risen by 20 per cent from $101,920 in 2017 to $121,826 in 2018.

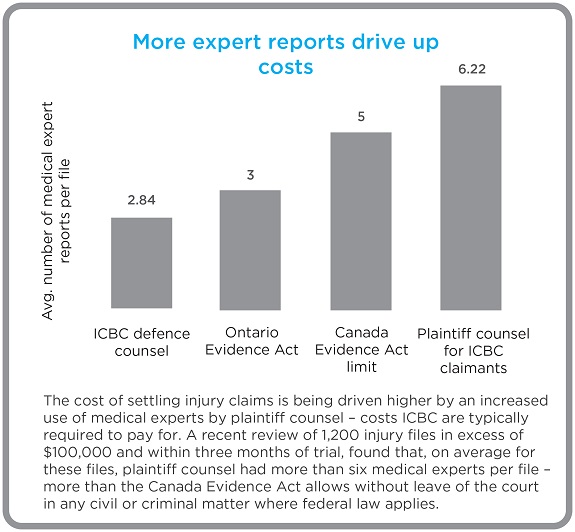

Plaintiff disbursement costs have increased by 21 per cent this fiscal year over last, with an increased use of medical experts which, in almost all cases, ICBC is responsible for paying for. A review of 1,200 selected injury files in excess of $100,000 and within three months of trial found that, on average for these files, plaintiff counsel had more than six medical experts per file, many with overlapping skills – more than the Canada Evidence Act allows without leave of the court in any civil or criminal matter where federal law applies.

ICBC's injury claims closure rate has also dipped recently, by 13 per cent, despite higher settlements being offered than ever before. The number of large loss claims, particularly those from prior years, continue to grow in cost. As of December 31, 2018, ICBC had approximately 5,600 pending large loss claims – an increase of 34 per cent over 2017 – currently costing approximately $490,000 each.

ICBC has approximately 110,000 open injury claims which are currently estimated to total at least $7 billion; costs which are expected to continue to increase. ICBC's estimate for its total unpaid injury claims – including those claims which have not yet been filed – is estimated to be even higher than that, in excess of $12 billion.

To compound these claims pressures, ICBC's investment income – which is relied on to help mitigate the pressure on insurance rates – has been unfavourably impacted by lower than expected capital gain and income distributions from pooled equity funds and asset impairments.

Media contact:

Lindsay Wilkins

604-982-4759